Artificial Intelligence (AI) has transformed trading by facilitating data-driven choices, immediate market assessments, and automated tactics. Platforms such as Tickeron, Trade Ideas, TrendSpider, Kavout and TradingView utilize AI to meet various trading requirements, ranging from day trading to long-term investment strategies. This analysis explores their core functionalities, strengths, and limitations, helping traders identify the best tool for their goals. Whether seeking high-probability trade signals, advanced charting, or portfolio management, each platform offers unique features to enhance trading efficiency and profitability.

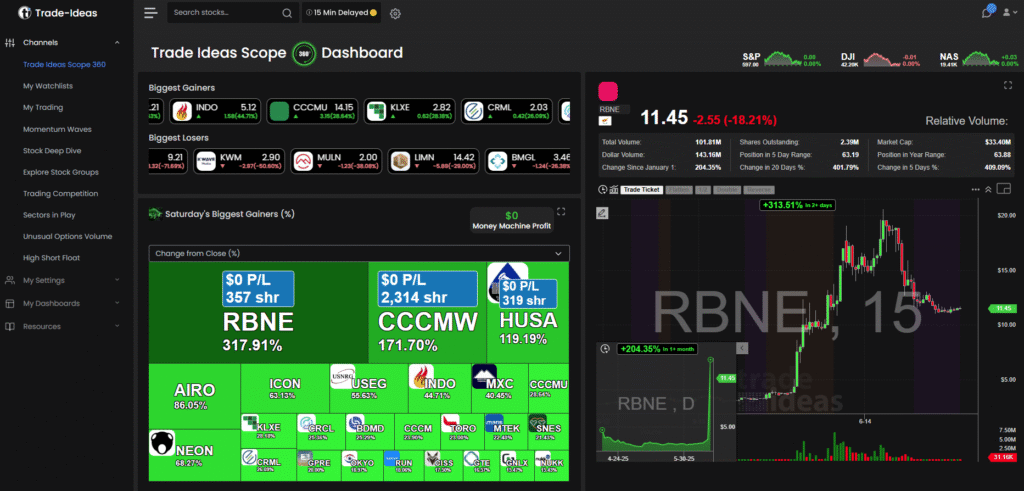

1. Trade Ideas

Overview and Usefulness:

Trade Ideas is a prominent AI-enhanced trading website specially designed for both swing and active day traders. It leverages advanced AI algorithms, including its proprietary Holly AI, to provide real-time stock scanning, trade signals, and automated trading capabilities. The platform excels at identifying high-probability trading opportunities, offering broker integration for commission-free auto-trading, and delivering actionable entry and exit signals. It is particularly useful for day traders who are looking for quick, data-driven decision-making.

Pros:

Powerful AI Signals: Holly AI creates high-probability signals for day trading based on real-time market evaluations.

Automated Trading: It supports complete automation of trading through broker integration, which helps reduce manual effort and emotional bias.

Customizable Scans: The platform offers a wide array of customization options for scanning stocks and ETFs, catering to unique trading strategies.

Proven Performance: Audited track record of AI algorithms outperforming the market.

Cons:

Steep Learning Curve: The complexity of the platform can be quite overwhelming for those just starting out.

High Cost: Subscription plans start at $127/month or $1068/year, which may be expensive for casual traders.

Limited Long-Term Focus: Primarily designed for day and swing trading, not ideal for long-term investors.

2. TrendSpider

Overview and Usefulness:

TrendSpider is a technical analysis platform that uses AI to automate the recognition of chart patterns, trendline detection, and allows user to implement backtesting before diving into it. It supports multiple asset classes (stocks, ETFs, forex, crypto, futures) and is ideal for traders who rely on technical analysis. Features like AI Strategy Lab and Trading Bots allow users to create, test, and automate strategies without coding, making it suitable for both novice and experienced traders.

Pros:

Advanced Pattern Recognition: Automatically detects candlestick patterns, Fibonacci levels, and trendlines across multiple timeframes.

Comprehensive Backtesting: No coding skills? Freight not as TrendSpider offers powerful tools for strategy testing that do not require coding skills.

Broker Integration: Connects with over 30 brokers for automated trade execution.

User-Friendly Guides: TrendSpider University offers tutorials to assist new users in navigating the platform.

Cons:

Complex Interface: Can be challenging for beginners despite tutorials.

Costly Plans: Subscriptions range from $33.15/month (Essential) to $89.50/month (Elite), which may deter budget-conscious traders.

Limited Fundamental Analysis: Focuses heavily on technical analysis, lacking in-depth fundamental data.

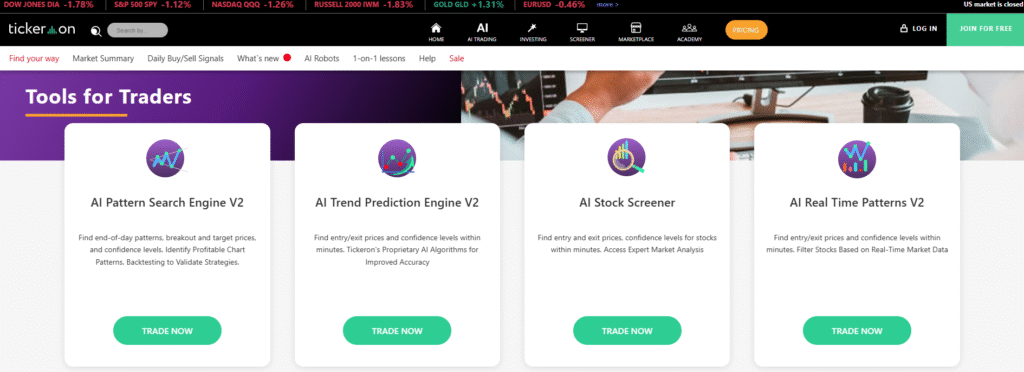

3. Tickeron

Overview and Usefulness:

Tickeron is an AI-powered platform that provides tools for ETFs, stocks, FX, and cryptocurrencies. It provides real-time chart pattern recognition, AI trading robots, and a Trend Prediction Engine with confidence scores for trade signals. Tickeron’s strength lies in swing trade as well as portfolio creation. Their 30+ AI stock trading systems and hedge fund-style portfolios are supported by verified track records. It’s suitable for traders seeking diverse, data-driven trading strategies.

Pros:

Real-Time Pattern Recognition: It can identify 40 stock chart patterns with success probabilities, making it ideal for swing and day traders.

Diverse AI Tools: Offers AI robots, trend prediction, and portfolio management, catering to various trading styles.

Free Tier Available: Basic features accessible without cost, with a 14-day free trial for premium plans.

Community Insights: There is an active and vibrant user community for sharing ideas and trading strategies. As they say, birds of the same feather flock together.

Cons:

Opaque Algorithms: The “Odds of Success” prediction engine lacks transparency, making it hard to understand signal rationale.

Limited Backtesting: Its backtesting features are not as comprehensive as those of platforms like TrendSpider.

High Premium Costs: Full access to AI tools requires expensive plans (e.g., $125/month for all AI Robots).

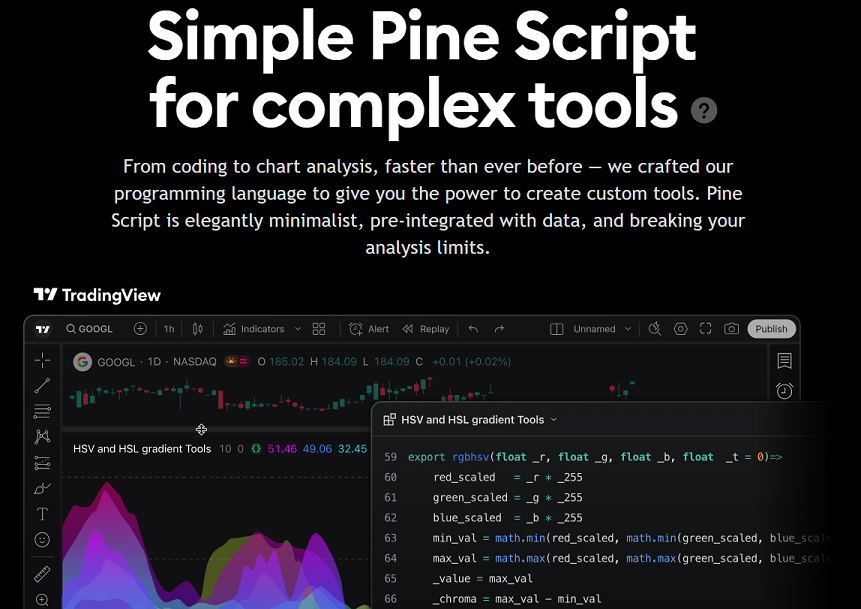

4. TradingView

Overview and Usefulness:

TradingView is a widely recognized financial trading platform with a robust community of over 100 million traders. It provides AI-enhanced charting, automated pattern recognition, and Pine Script for creating custom trading scripts. The platform encompasses stocks, ETFs, forex, crypto, and more, making it adaptable for traders of all experience levels who appreciate community engagement and access to global market data.

Pros:

Global Community: A large and active community for exchanging ideas, indicators, and strategies.

Customizable Scripting: Pine Script allows advanced traders to create custom indicators and strategies.

Broad Market Coverage: Supports multiple asset classes with extensive charting tools (e.g., LineBreak, Kagi, Heikin Ashi).

Affordable Plans: Free tier is available whereas the basic paid plans start at $13.99/month (Essential).

Cons:

Limited Automation: Lacks fully automated trading bots compared to Trade Ideas or TrendSpider.

Learning Curve for Scripting: Pine Script necessitates coding knowledge for advanced customization.

Premium Features Cost Extra: Advanced AI and automation features require higher-tier subscriptions.

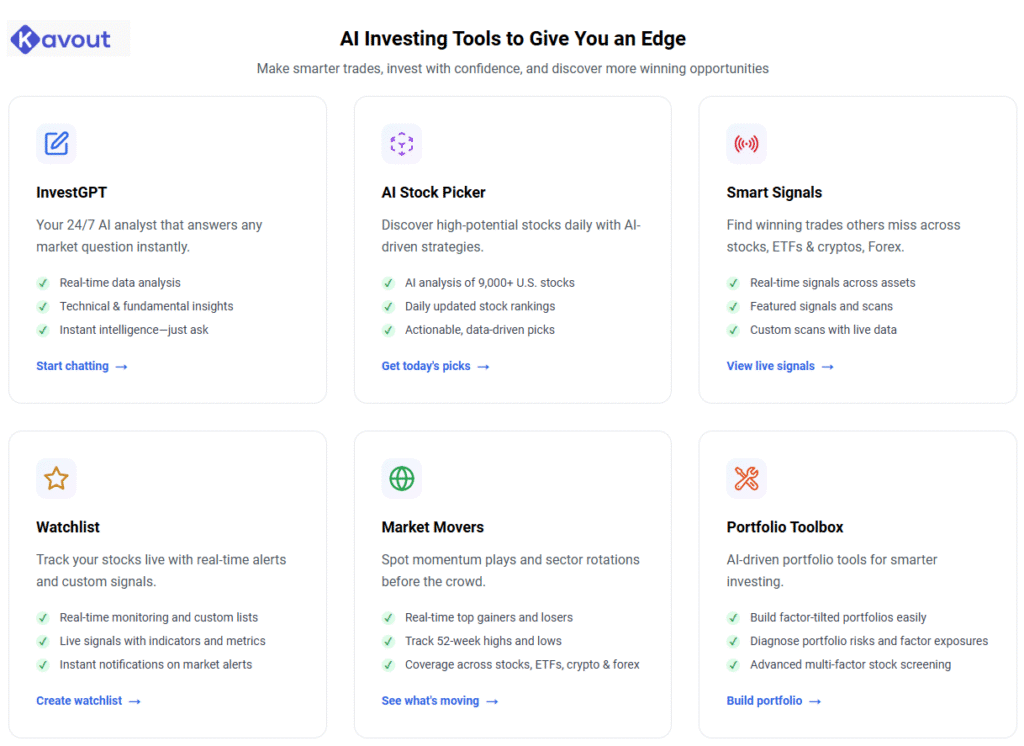

5. Kavout

Overview and Usefulness:

Kavout is an AI investing platform powered by its “Kai” machine learning system, focusing on long-term portfolio management and stock selection for stocks and crypto. It offers a Portfolio Toolbox, K Score (a 1-9 stock rating system), and tools like InvestGPT for AI-driven insights. Most ideal for investors who rank data-driven portfolio building capability over active trading forecasts.

Pros:

K Score System: Its rating system gives stocks a score based on 200+ factors (quality, value, momentum), which greatly simplifies stock selection.

Portfolio Management: Tools for building diversified portfolios and avoiding correlated stocks.

Free Access: Currently free for basic features, making it accessible for new investors.

Alternative Data: Analyzes news, blogs, and social media for comprehensive market insights.

Cons:

Limited Automation: There is a reduced emphasis on automated trading compared to Trade Ideas or TrendSpider.

US Market Focus: Primarily analyzes US stock market data, limiting global applicability.

No Direct Recommendations: Requires users to make final decisions, which may not suit those seeking explicit trade signals.

Conclusion

The AI trading platforms—Trade Ideas, TrendSpider, Tickeron, TradingView, and Kavout—each offer unique advantages suited to different trading styles.

Trade Ideas: Best for day traders needing real-time AI signals and automation but costly and complex.

TrendSpider: Ideal for technical traders with strong pattern recognition and backtesting, though the plans might not be the most economical. Some of its features may also require some technical skills.

Tickeron: Its versatility comes in the form of swing trading as well as portfolio building with the assistance of its AI tools. However, its lack of backtesting features and certain transparency may not be the cup of tea for everyone.

TradingView: Great for community-driven charting and global market coverage, but automation is limited without premium plans.

Kavout: Suited for long-term investors with free portfolio tools, but lacks robust automation and global market scope.

Each platform caters to different trading styles—day trading (Trade Ideas), technical analysis (TrendSpider), swing trading/portfolios (Tickeron), community charting (TradingView), or long-term investing (Kavout). Traders should match their choice with their experience, budget, and objectives, taking advantage of free trials or paper trading to assess platforms before making a decision. By selecting the right tool, traders can harness AI to optimize strategies and navigate dynamic markets effectively.