Backtesting is essential for developing trading strategies, as it allows traders and quantitative analysts to test their ideas against past data before investing money. For those who know how to code, these backtesting platforms offer unparalleled flexibility, thus allowing traders to have precise customization and integration with advanced analytical tools.

Here we explore the best coding-based backtesting platforms—QuantConnect, Backtrader, Zipline, TradeStation, Amibroker, TradingView, MetaTrader 5, NinjaTrader, QuantLib, and Trality—detailing their features, strengths, and considerations to help traders choose the right tool.

QuantConnect

QuantConnect is a leading open-source platform for algorithmic trading, recognized for its comprehensive backtesting and live trading functionalities. It is designed for developers who are proficient in various programming languages.

Key Features

Language Support: Python, C#, and F# are available for strategy creation.

Data Access: Free historical data for equities, forex, futures, and cryptocurrencies, with premium high-resolution options.

Cloud-Based: Runs backtests in the cloud system, thus minimizing the need for local computational requirements.

Community Resources: An active community enhances a rich repository of algorithms and indicators.

Live Trading: Integrates with brokers like Interactive Brokers and Alpaca for seamless execution.

Strengths: QuantConnect’s open-source LEAN engine allows deep customization, appealing to advanced users. Its cloud infrastructure efficiently processes large datasets, such as tick-level data spanning decades. Integration with Jupyter Notebook allows for interactive coding and visualization, making it extremely suitable for iterative strategy development. The platform also offers a local deployment option, granting full control to seasoned developers.

Considerations: However, the platform’s complexity may pose challenges for novices, particularly those lacking experience in object-oriented programming. While Python is well-supported, some advanced features favor C#. High-frequency data requires premium subscriptions, increasing costs.

Backtrader

Backtrader is a backtesting framework built on Python, celebrated for its ease of use and adaptability, which makes it a top choice for Python developers.

Key Features

Python as its Core: It integrates with NumPy and Pandas for data handling and management.

Flexibility in Data: It easily supports CSV files, Interactive Brokers feeds, Yahoo Finance and even Alpaca

Custom Indicators: Enables easy creation of tailored technical indicators and strategies.

Visualization: Includes built-in plotting capabilities for equity curves and trade analysis.

Multi-Asset Support: Capable of managing multiple assets and timeframes at once.

Strengths: Backtrader’s user-friendly API reduces the entry barrier for Python users, while its adaptability accommodates intricate strategies such as multi-asset portfolios. The ability to integrate custom data feeds is perfect for proprietary datasets. Its lightweight architecture operates efficiently on basic hardware, which is advantageous for individual traders.

Considerations: Lacking native cloud support, users are often required to oversee their own computational resources, thus adding more cost to their overall trading journey. Backtrader is primarily focused on backtesting, offering limited options for live trading integration. The process of manual data preprocessing can also be quite time-consuming.

Zipline

Zipline, originally developed by Quantopian, is a Python-based open-source library favored in academic and professional settings for its robust backtesting capabilities.

Key Features

Python Based Ecosystem: Seamless integration with NumPy, Pandas, and Matplotlib for analysis and visualization functions.

Realistic Simulation: Trading simulation takes into consideration realistic slippage and transaction costs.

Data Bundles: Supports custom data, with default integration for Quandl and Yahoo Finance.

Pipeline API: Facilitates dynamic portfolio selection tailored for quantitative strategies.

Community Support: Active open-source community with extensive documentation.

Strengths: Zipline’s integration with Python’s data science stack suits researchers combining backtesting with machine learning or statistical analysis. Its event-driven engine ensures realistic simulations, accounting for market dynamics. The Pipeline API is effective for systematic strategies like factor-based investing.

Considerations: Setup can be complex, requiring data bundle configuration. Zipline is mainly designed for backtesting, while unfortunately offers limited support for live trading. Its single-threaded design may slow performance with large datasets.

TradeStation (EasyLanguage)

TradeStation is a proprietary trading platform with EasyLanguage, a scripting language designed for coding and backtesting strategies, popular among retail and professional traders.

Key Features

EasyLanguage: User-friendly scripting focused on trading logic.

High-Quality Data: Decades of historical data for equities, futures, forex, and options.

Optimization Tools: Tests parameter combinations to refine strategies.

Broker Integration: Direct connection with TradeStation’s brokerage.

Advanced Charting: Robust visualization for backtest results.

Strengths: EasyLanguage’s simplicity appeals to traders with limited coding experience. High-quality data and broker integration streamline testing-to-execution workflows. Optimization tools enhance strategy performance.

Considerations: TradeStation’s proprietary nature limits flexibility. EasyLanguage is less versatile than Python. Subscription and data fees can be significant.

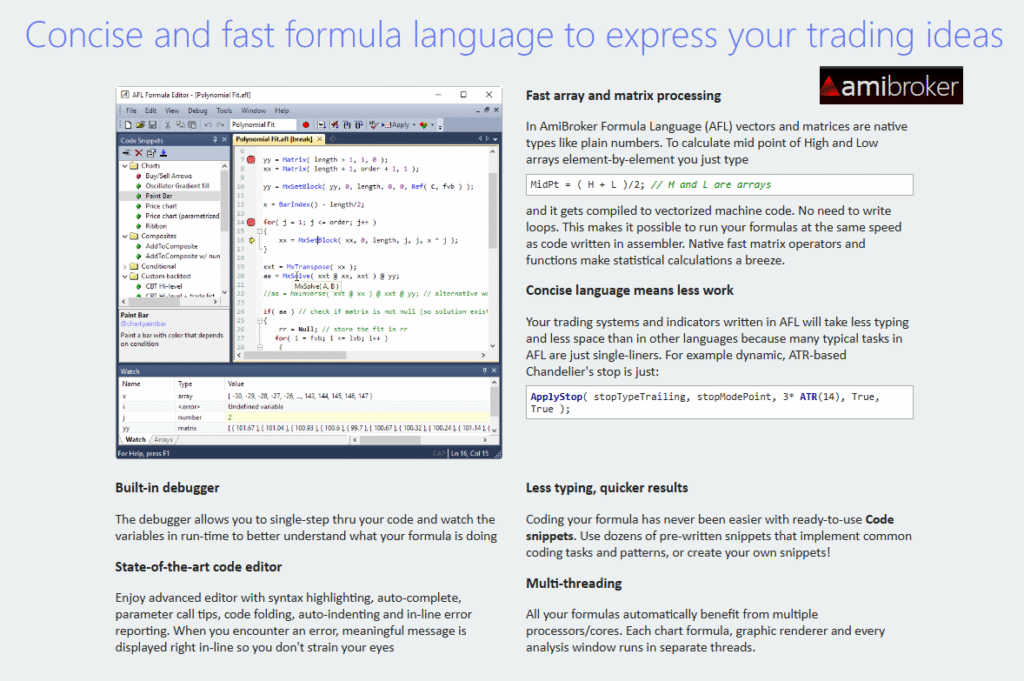

Amibroker

Amibroker is a high-performance platform using AFL (Amibroker Formula Language), favored for its speed and customization in technical analysis and backtesting.

Key Features

AFL Language: Optimized for trading and technical analysis.

High Performance: Fast backtesting engine for large datasets.

Portfolio Testing: Supports important trading factors such as position sizing and risk management.

Data Integration: Compatible with Yahoo Finance, Quandl, and premium feeds.

Extensive Library: Vast indicator and metric library.

Strengths: Amibroker’s efficiency suits complex strategies across large datasets. AFL is meant to be intuitive for technical traders’ usage, while its portfolio testing is also a robust process. Its one-time licensing model is cost-effective.

Considerations: Learning AFL may deter Python developers. Outdated interface as well as third-party tools is required for live trading. Data sourcing is hard to come by without paying.

TradingView

TradingView is a premier charting platform that uses Pine Script, a language for developing custom indicators and strategies as well as backtesting.

Key Features

Pine Script: Simple scripting for indicators and strategies.

Extensive Data: Historical data for stocks, forex, cryptocurrencies, and futures.

Interactive Charting: Industry-leading visualization tools.

Community Scripts: A plethora of shared Pine Script codes.

Cloud-Based: Backtesting is conducted in the cloud with chart integration.

Strengths: Pine Script is popular with traders and programmers that may have limited coding skills. TradingView’s charting capabilities enhance strategy analysis. Community scripts accelerate development, and cloud-based testing requires no local setup.

Considerations: With simplicity comes lesser flexibility and thus, this limits Pine Script’s ability to test on complex strategies. Its reliance on TradingView’s data for backtesting causes it to lack granularity.

MetaTrader 5 (MQL5)

MetaTrader 5 is a well-regarded forex and multi-asset trading platform that includes MQL5, a C-like programming language for strategy coding and backtesting.

Key Features

MQL5: A powerful language for developing indicators, expert advisors, and scripts.

Multi-Asset Data: Historical data is provided for forex, stocks, futures, and CFDs.

Strategy Tester: A built-in tool that allows for backtesting as well as optimization.

Broker Integration: Connects with numerous brokers for live trading.

Marketplace: Community-driven marketplace for strategies and tools.

Strengths: MQL5’s C-like syntax can be easily accessed by developers, thus supporting the need to program more complex and sophisticated algorithms. MetaTrader’s widespread broker support ensures easy live trading transitions. The strategy tester offers detailed performance metrics, and the marketplace provides ready-made solutions.

Considerations: MQL5 is platform-specific, limiting portability. Data quality depends on the broker, and high-resolution data may require external sources. The learning curve can be steep for non-programmers.

NinjaTrader (NinjaScript)

NinjaTrader is a trading platform for futures using NinjaScript (C#) for coding strategies and backtesting.

Key Features

NinjaScript: C#-based programming language is used as its base for testing custom designed indicators and strategies.

High-Quality Data: Historical data is available for futures, forex, and stocks.

Strategy Analyzer: Advanced backtesting with optimization tools.

Broker Integration: Supports brokers like NinjaTrader Brokerage and TD Ameritrade.

Charting Tools: Customizable charts for strategy visualization.

Strengths: NinjaScript leverages C#’s power, appealing to developers. The Strategy Analyzer provides detailed backtesting and optimization. Broker integration facilitates live trading, and charting tools enhance analysis.

Considerations: NinjaScript requires C# knowledge, which may intimidate beginners. The costs associated with the platform, including data fees, can accumulate.

QuantLib

QuantLib serves as an open-source library written in C for the field of quantitative finance, enabling the modeling, pricing, and backtesting of sophisticated financial instruments.

Key Features

C++-Based: High-performance library for quantitative analysis.

Flexible Modeling: Supports derivatives, fixed income, and equities.

Custom Data: Integrates with user-provided historical data.

Cross-Platform: Runs on Windows, Linux, and macOS.

Community Support: Active open-source community.

Strengths: QuantLib’s performance and flexibility suit advanced quants working on derivatives or structured products. Its open-source nature allows full customization, and C++ ensures fast computation for large datasets.

Considerations: QuantLib’s complexity and C++ requirement demand significant programming expertise.

It is devoid of a user-friendly interface and built-in data, which means it requires external data sources and tailored setups.

Trality

Trality is a cloud-based platform for coding algorithmic trading bots, primarily for cryptocurrencies, using Python.

Key Features

Python-Based: Browser-based Python editor for strategy development.

Crypto Data: Historical and real-time data for major cryptocurrencies.

Cloud Backtesting: Optimization tools and features are tested in the cloud.

Live Trading: Works with exchanges like Binance and Kraken.

Rule Builder: Combines coding with a drag-and-drop interface.

Strengths: Trality’s Python editor is user-friendly for crypto traders, and its cloud-based setup streamlines backtesting.Exchange integration supports quick live trading deployment. The rule builder aids less experienced coders.

Considerations: Trality is focused on cryptocurrencies, which limits its application for other types of asset classes. Advanced strategies may require premium plans. The platform is newer, with a smaller community than QuantConnect.

Choosing the Right Platform

Selecting a backtesting platform depends on your coding skills, strategy complexity, and trading goals:

Python Users: If you are already a skilled python programmer, Backtrader, Zipline, and Trality may speed up your development.

Cloud-Based Needs: QuantConnect, TradingView, and Trality offer scalable cloud solutions.

Broker Integration: TradeStation, MetaTrader 5, and NinjaTrader streamline live trading and make things easier for you to move on to the next step – actual trading!

Performance: Amibroker and QuantLib are designed to allow testers to load up with large datasets.

Charting and Community: TradingView and MetaTrader 5 provide visualization and shared resources.

Conclusion

Coding-based backtesting platforms empower traders to build precise, data-driven strategies and models to be tested first before sinking both the money and time into it. By aligning your choice with your programming expertise, asset focus, and trading objectives, you can leverage these platforms to test and refine strategies, paving the way for informed and confident trading decisions.